Table of Contents

Semiconductor Stocks Continue to Lead U.S. Market

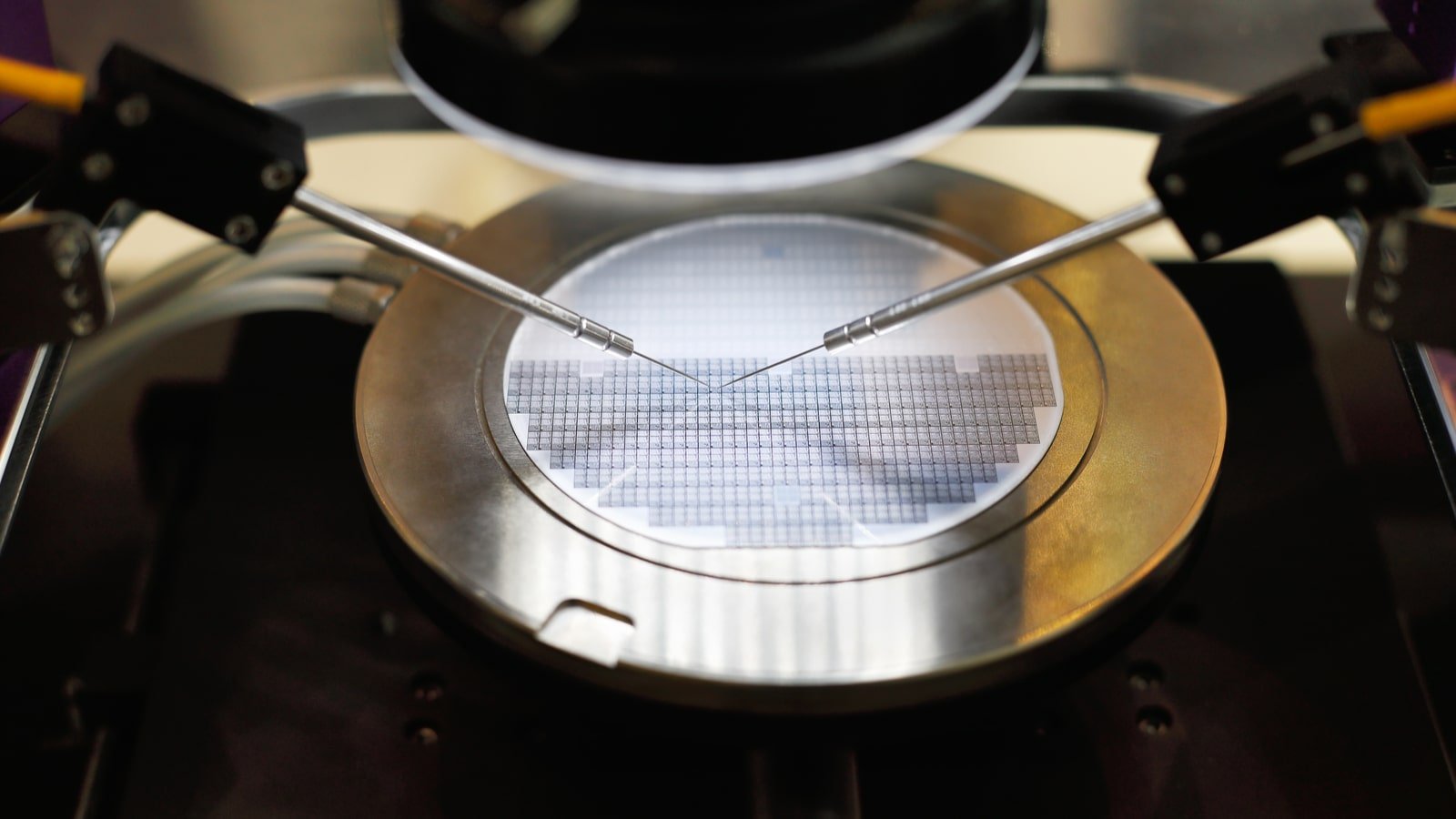

The U.S. stock market continues to be led by semiconductor stocks, with the iShares Semiconductor ETF rising more than 14% on a year-to-date basis, outperforming all other market indices. This ETF holds 35 semiconductor stocks operating across various sub-verticals of the space. As technology increasingly necessitates advanced semiconductor chips, it makes sense that semiconductor stocks have largely done well, especially as society moves into the age of artificial intelligence (AI) and advanced cloud computing.

Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing are three semiconductor companies that investors should consider. Nvidia has seen its share price more than triple over the past 12 months, and its recent announcement of a new lineup of “Blackwell” server GPUs is expected to extend its lead in the AI market. Broadcom specializes in designing and selling networking chips that help to process large amounts of data needed for artificial intelligence computing and is expected to generate $10 billion of revenue from chip sales related to AI. Taiwan Semiconductor Manufacturing, on the other hand, is the manufacturer behind most of the world’s advanced chips and has seen a rise of more than 68% in its shares on a year-to-date basis.

Despite interest rate concerns, U.S. equities seem to be back in rally territory, and these three semiconductor companies are expected to continue leading the charge in the stock market. The demand for AI technologies and the crucial role of these companies in enabling them make them instrumental to powering the tech boom this year and for many years to come.